The global of real estate investing is filled with jargon and complex economic techniques, but one term that regularly sticks out is the “1031 Exchange for Dummies.” Named after Section 1031 of the Internal Revenue Code, this approach allows buyers to defer capital profits taxes after they promote a belongings and reinvest the proceeds into a comparable assets. Here’s a honest manual to understanding the 1031 Exchange for Dummies, perfect for novices.

What is a 1031 Exchange for Dummies?

A 1031 Exchange for Dummies, also known as a like-type exchange, is a effective tax-deferral tool used in actual estate making an investment. Essentially, it permits buyers to sell a property and reinvest the proceeds into some other belongings with out straight away paying capital profits taxes on the income. The most important benefit of this is the ability to keep extra money working for you in the marketplace, in preference to giving a big component to the authorities in taxes.

Key Requirements for a 1031 Exchange for Dummies

For a transaction to qualify as a 1031 Exchange for Dummies, it have to meet precise necessities:

Like-Kind Property: The houses exchanged must be of “like-kind,” that means they have to be of the same nature or man or woman, even if they differ in grade or exceptional. This is extensively interpreted in actual property, so maximum real homes are taken into consideration like-type to every other.

Investment or Business Use: Both the relinquished assets (the one being sold) and the alternative property (the only being purchased) must be held for investment or utilized in a alternate or enterprise. Personal houses do no longer qualify.

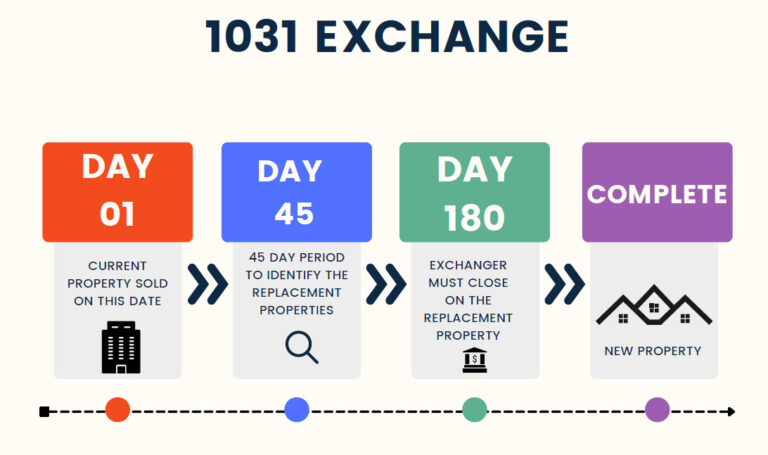

- Timeline Constraints: There are strict timelines that must be adhered to:

- 45-Day Identification Period: Within forty five days of selling the relinquished assets, the investor should become aware of potential substitute residences.

- 180-Day Exchange Period: The acquisition of the replacement assets must be completed inside 180 days of the sale of the relinquished belongings.

- Qualified Intermediary: A qualified intermediary (QI) need to be used to facilitate the alternate. The QI holds the proceeds from the sale of the relinquished assets and uses them to purchase the alternative belongings.

Benefits of a 1031 Exchange for Dummies

The primary benefit of a 1031 Exchange for Dummies is the deferral of capital gains taxes, which allows the investor to leverage extra capital for future investments. Here are a few extra blessings:

- Increased Purchasing Power: By deferring taxes, buyers can use the whole quantity of the proceeds to buy a more valuable replacement belongings, potentially main to better returns.

- Portfolio Diversification: Investors can use a 1031 Exchange for Dummies to diversify their actual property portfolio by way of reinvesting in unique sorts of properties or exceptional geographic locations.

- Estate Planning: 1031 Exchange for Dummiess can be a beneficial tool in property making plans. Heirs can receive a stepped-up foundation on inherited property, doubtlessly disposing of capital profits taxes altogether.

Potential Pitfalls and Risks

While a 1031 Exchange for Dummies offers numerous blessings, it’s now not without its risks and demanding situations:

- Strict Timelines: The 45-day identity duration and one hundred eighty-day alternate duration are non-negotiable. Missing those closing dates can result in the disqualification of the alternate and the immediately popularity of capital profits.

- Identification Rules: There are particular regulations about the number and fee of homes that may be diagnosed inside the 45-day length. Misidentifying houses can jeopardize the trade.

- Market Risk: The actual estate marketplace may be unstable, and there’s no guarantee that appropriate alternative houses will be to be had in the required timeframe.

- Complexity: The 1031 Exchange for Dummies process may be complex and requires cautious making plans and execution. It’s advisable to work with skilled specialists, consisting of actual property dealers, tax advisors, and certified intermediaries.

Step-by-Step Guide to Completing a 1031 Exchange for Dummies

- Consult with Professionals: Before starting up a 1031 Exchange for Dummies, seek advice from a tax marketing consultant and a actual estate expert to make certain it’s the proper method for your situation.

- List and Sell the Relinquished Property: Put your home in the marketplace and promote it. Remember, you cannot contact the proceeds; they must be held by using a certified intermediary.

- Identify Replacement Properties: Within forty five days of the sale, become aware of ability alternative residences. You can identify up to a few residences without regard to their truthful market value, or greater than three if their overall value does now not exceed 200% of the price of the relinquished assets.

- Purchase the Replacement Property: Complete the acquisition of the replacement assets inside 180 days of the sale. The qualified middleman will use the proceeds from the sale to buy the new belongings.

- Report the Exchange: On your tax go back for the year the alternate happened, report the 1031 Exchange for Dummies the usage of IRS Form 8824.

Common Scenarios for Using a 1031 Exchange for Dummies

- Upgrading Properties: Investors frequently use 1031 Exchange for Dummiess to upgrade from smaller residences to large, extra precious ones. For example, an investor may alternate a single-family condominium home for a multi-circle of relatives condo constructing.

- Diversification: If an investor owns multiple properties in a single location, they might use a 1031 Exchange for Dummies to diversify into one-of-a-kind geographic regions, spreading hazard and taking advantage of increase possibilities in different markets.

- Consolidation: Conversely, an investor with several smaller homes might use a 1031 Exchange for Dummies to consolidate into one large property, simplifying management and doubtlessly growing performance.

Conclusion

A 1031 Exchange for Dummies is a effective device for real estate traders trying to defer taxes, growth their buying electricity, and strategically develop their portfolios. However, it calls for careful making plans, adherence to strict guidelines, and the steering of experienced professionals. By expertise the basics of a 1031 Exchange for Dummies, you could make knowledgeable choices and leverage this strategy to obtain your lengthy-term investment dreams.